Automatically copy the strategies of experienced traders and participate in global markets without trading on your own.

Copy trading allows you to automatically replicate the trades of experienced traders in real time. When they trade, your account follows, proportionally and transparently.

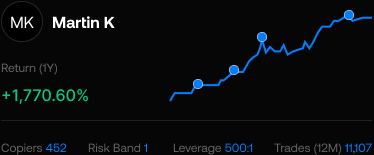

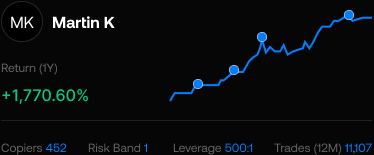

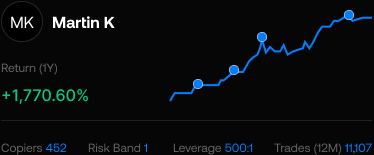

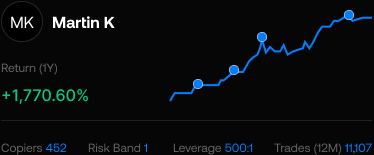

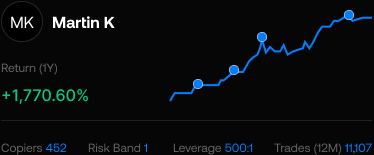

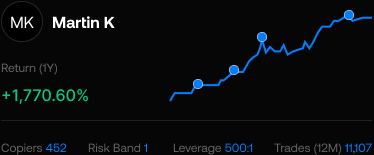

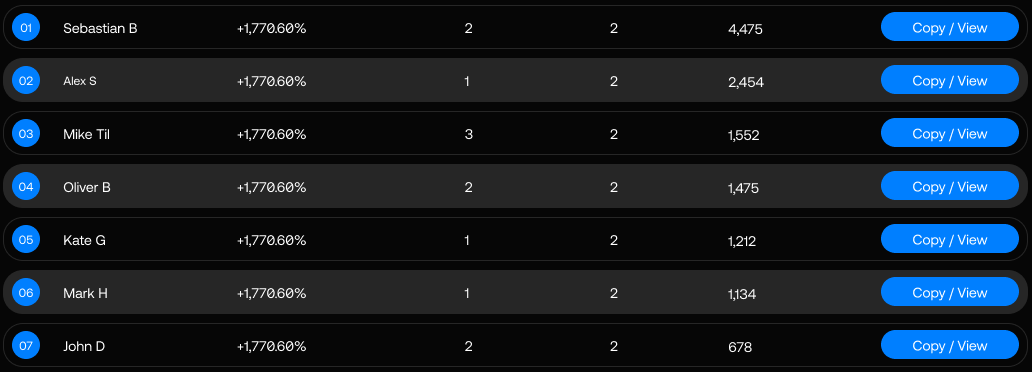

Strategy providers are experienced traders who share their trading strategies, allowing others to follow their performance transparently.

Strategy providers are experienced traders who share their trading strategies, allowing others to follow their performance transparently.

Copy trading is designed for traders who want exposure without complexity.

Choose a strategy, allocate funds, and trade beyond the boundaries.

Access the world’s most traded financial markets from a single, unified trading environment. From global currencies and major indices to digital assets and commodities, trade with clarity, precision, and full market coverage — all designed to move at your speed.

To start copy trading with UEXO, open and fund your trading account, access the copy trading platform, select a strategy provider, and allocate your preferred investment amount. Once activated, trades are automatically replicated in your account.

Yes. Copy trading can be suitable for beginners, as it allows you to follow experienced strategy providers without actively managing trades yourself. However, it is important to understand the risks involved before allocating capital.

Yes. You can stop copying a strategy provider at any time, giving you full control over your investment and the ability to close or manage open positions as needed.

Copy trading mainly involves a performance fee based on the profits generated by the strategy provider. Standard trading costs, such as spreads and applicable commissions depending on account type, may also apply. All fees are transparently shown before activation.

Copy trading involves market risk, and losses can occur if the strategy provider’s trades are unsuccessful. Past performance does not guarantee future results, and capital is subject to market fluctuations.

Yes. UEXO’s copy trading services are provided through entities regulated by the FSCA (South Africa), FSC (Mauritius), & CMA (UAE). These regulated entities operate under applicable financial standards to ensure compliance and client fund protection measures.

Expert insights, real-time market updates, and practical education for smarter forex decisions.